Tech war brewing as China hits back at U.S. restrictions on advanced computer chips – National | 24CA News

Furious at U.S. efforts that minimize off entry to expertise to make superior laptop chips, China’s leaders look like struggling to determine tips on how to retaliate with out hurting their very own ambitions in telecoms, synthetic intelligence and different industries.

President Xi Jinping’s authorities sees the chips which might be utilized in all the pieces from telephones to kitchen home equipment to fighter jets as essential property in its strategic rivalry with Washington and efforts to achieve wealth and international affect. Chips are the middle of a “technology war,” a Chinese scientist wrote in an official journal in February.

China has its personal chip foundries, however they provide solely low-end processors utilized in autos and home equipment. The U.S. authorities, beginning underneath then-President Donald Trump, is reducing off entry to a rising array of instruments to make chips for laptop servers, AI and different superior purposes. Japan and the Netherlands have joined in limiting entry to expertise they are saying is likely to be used to make weapons.

Xi, in unusually pointed language, accused Washington in March of making an attempt to dam China’s growth with a marketing campaign of “containment and suppression.” He referred to as on the general public to “dare to fight.”

Despite that, Beijing has been gradual to retaliate in opposition to U.S. firms, presumably to keep away from disrupting Chinese industries that assemble a lot of the world’s smartphones, pill computer systems and different shopper electronics. They import greater than $300 billion price of international chips yearly.

The ruling Communist Party is throwing billions of {dollars} at making an attempt to speed up chip growth and cut back the necessity for international expertise.

China’s loudest criticism: It is blocked from shopping for a machine obtainable solely from a Dutch firm, ASML, that makes use of ultraviolet gentle to etch circuits into silicon chips on a scale measured in nanometers, or billionths of a meter. Without that, Chinese efforts to make transistors sooner and extra environment friendly by packing them extra carefully collectively on fingernail-size slivers of silicon are stalled.

Making processor chips requires some 1,500 steps and applied sciences owned by U.S., European, Japanese and different suppliers.

“China won’t swallow everything. If damage occurs, we must take action to protect ourselves,” the Chinese ambassador to the Netherlands, Tan Jian, informed the Dutch newspaper Financieele Dagblad.

“I’m not going to speculate on what that might be,” Tan mentioned. “It won’t just be harsh words.”

The battle has prompted warnings the world may decouple, or break up into separate spheres with incompatible expertise requirements that imply computer systems, smartphones and different merchandise from one area wouldn’t work in others. That would increase prices and may gradual innovation.

“The bifurcation in technological and economic systems is deepening,” Prime Minister Lee Hsien Loong of Singapore mentioned at an financial discussion board in China final month. “This will impose a huge economic cost.”

U.S.-Chinese relations are at their lowest degree in a long time because of disputes over safety, Beijing’s therapy of Hong Kong and Muslim ethnic minorities, territorial disputes and China’s multibillion-dollar commerce surpluses.

Chinese industries will “hit a wall” in 2025 or 2026 if they will’t get subsequent era chips or the instruments to make their very own, mentioned Handel Jones, a tech trade marketing consultant.

China “will start falling behind significantly,” mentioned Jones, CEO of International Business Strategies.

Beijing may need leverage, although, as the largest supply of batteries for electrical automobiles, Jones mentioned.

Chinese battery large CATL provides U.S. and Europe automakers. Ford Motor Co. plans to make use of CATL expertise in a $3.5 billion battery manufacturing facility in Michigan.

“China will strike back,” Jones mentioned. “What the public might see is China not giving the U.S. batteries for EVs.”

On Friday, Japan elevated strain on Beijing by becoming a member of Washington in imposing controls on exports of chipmaking gear. The announcement didn’t point out China, however the commerce minister mentioned Tokyo doesn’t need its expertise used for army functions.

A Chinese international ministry spokeswoman, Mao Ning, warned Japan that “weaponizing sci-tech and trade issues” would “hurt others as well as oneself.”

Hours later, the Chinese authorities introduced an investigation of the largest U.S. reminiscence chip maker, Micron Technology Inc., a key provider to Chinese factories. The Cyberspace Administration of China mentioned it might search for nationwide safety threats in Micron’s expertise and manufacturing however gave no particulars.

The Chinese army additionally wants semiconductors for its growth of stealth fighter jets, cruise missiles and different weapons.

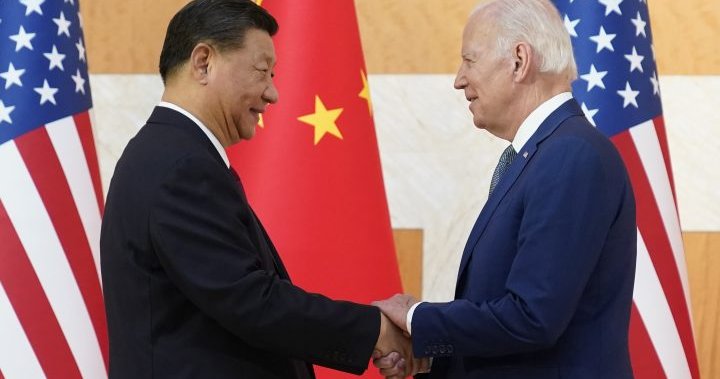

Chinese alarm grew after President Joe Biden in October expanded controls imposed by Trump on chip manufacturing expertise. Biden additionally barred Americans from serving to Chinese producers with some processes.

To nurture Chinese suppliers, Xi’s authorities is stepping up help that trade specialists say already quantities to as a lot as $30 billion a yr in analysis grants and different subsidies.

China’s greatest maker of reminiscence chips, Yangtze Memory Technologies Corp., or YMTC, acquired a 49 billion yuan ($7 billion) infusion this yr from two official funds, in line with Tianyancha, a monetary info supplier.

One was the federal government’s primary funding automobile, the China National Integrated Circuit Industry Investment Fund, generally known as the Big Fund. It was based in 2014 with 139 billion yuan ($21 billion) and has invested in lots of of firms.

The Big Fund launched a second entity, generally known as the Big Fund II, in 2019 with 200 billion yuan ($30 billion).

In January, chip producer Hua Hong Semiconductor mentioned Big Fund II would contribute 1.2 billion yuan ($175 million) for a deliberate 6.7 billion yuan ($975 million) wafer fabrication facility in japanese China’s Wuxi.

In March, the Cabinet promised tax breaks and different help for the trade. It gave no price ticket. The authorities additionally has arrange “integrated circuit talent training bases” at 23 universities and 6 at different faculties.

Junwei Luo, a scientist on the official Institute of Semiconductors, wrote within the February challenge of the journal of the Chinese Academy of Sciences. Luo referred to as for “self-reliance and self-improvement in semiconductors.”

The scale of spending required is big. The international trade chief, Taiwan Semiconductor Manufacturing Corp., or TSMC, is within the third yr of a three-year, $100 billion plan to broaden analysis and manufacturing.

Developers together with Huawei Technologies Ltd. and VeriSilicon Holdings Co. can design logic chips for smartphones as highly effective as these from Intel Corp., Apple Inc., South Korea’s Samsung Electronics Co. or Britain’s Arm Ltd., in line with trade researchers. But they can’t be manufactured with out the precision expertise of TSMC and different international foundries.

Trump in 2019 crippled Huawei’s smartphone model by blocking it from shopping for U.S. chips or different expertise. American officers say Huawei, China’s first international tech model, may facilitate Chinese spying, an accusation the corporate denies. In 2020, the White House tightened controls, blocking TSMC and others from utilizing U.S. expertise to supply chips for Huawei.

Washington threw up new hurdles for Chinese chip designers in August by imposing restrictions on software program generally known as EDA, or digital design automation, together with European, Asian and different governments to restrict the unfold of “dual use” applied sciences that is likely to be used to make weapons.

In December, Biden added YMTC, the reminiscence chip maker, and another Chinese firms to a blacklist that limits entry to chips made wherever utilizing U.S. instruments or processes.

China’s foundries can etch circuits as small as 28 nanometers aside. By distinction, TSMC and different international opponents can etch circuits simply three nanometers aside, ten occasions the Chinese trade’s precision. They are shifting towards two nanometers.

To make the newest chips, “you need EUV (extreme ultraviolet lithography) tools, a very complicated process recipe and not just a couple of billion dollars but tens and tens of billions of dollars,” mentioned Peter Hanbury, who follows the trade for Bain & Co.

“They’re not going to be able to produce competitive server, PC and smartphone chips,” Hanbury mentioned. “You have to go to TSMC to do that.”

China’s ruling social gathering is making an attempt to develop its personal instrument distributors, however researchers say it’s far behind a worldwide community unfold throughout dozens of nations.

Huawei mentioned in a video on its web site in December it was engaged on EUV expertise. But making a machine similar to ASML’s may cost $5 billion and require a decade of analysis, in line with trade specialists. Huawei didn’t reply to a request for remark.

The day when China can provide its personal EUV machine is “very far away,” mentioned Hanbury.

— AP researcher Yu Bing in Beijing and AP Writer Mike Corder in Amsterdam contributed.