Key Canada-U.S. oil pipeline outage could lead to crude supply shortage in the States: experts | 24CA News

An outage on the biggest oil pipeline to the United States from Canada might have an effect on inventories at a key U.S. storage hub and reduce crude provides to 2 oil-refining facilities, analysts and merchants mentioned on Friday.

TC Energy’s Keystone pipeline ferries about 600,000 barrels of Canadian crude per day (bpd) to the United States. It was shut late Wednesday after a breach spewed greater than 14,000 barrels of oil right into a Kansas creek, making it the biggest crude spill within the United States in practically a decade.

Read extra:

Canada’s fuel costs have fallen — however it might not final lengthy, analysts warn

Read More

While TC Energy has but to say when it might restart the pipeline, a earlier Keystone spill affected operations for two weeks.

“The main question continues to be the duration of the potential outage… the longer the duration, ultimately, of course means potentially tighter inventories in Cushing or heavy (crude) on the Gulf Coast,” mentioned Michael Tran, a managing director at RBC Capital markets.

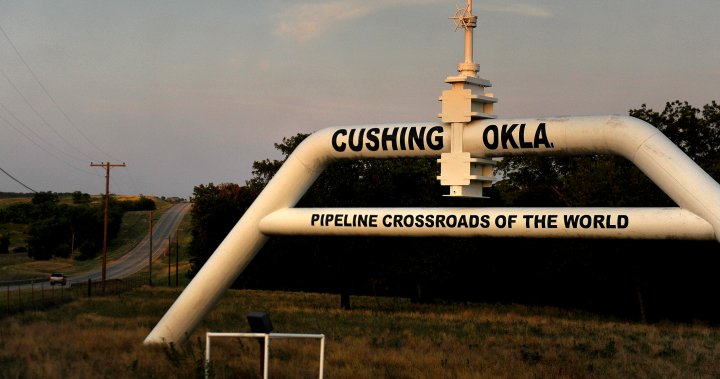

The line runs on to the Cushing, Oklahoma, storage hub, which is at the moment about a 3rd full with practically 24 million barrels in inventory.

If the road is closed for greater than every week, it might scale back Cushing shares by about 2.5 million barrels, knowledge analytics agency Wood Mackenzie mentioned.

If the outage final for greater than 10 days, it might push Cushing storage to close the operational minimal of 20 million barrels, mentioned AJ O’Donnell, a director at pipeline researcher East Daley Capital.

Other pipelines between Canada and the United States are at or close to capability, East Daley and Wood Mackenzie estimates.

“There’s nowhere near enough to take 600,000 barrels a day. There’s just not enough pipe right now,” O’Donnell mentioned.

Refineries within the U.S. Midwest could also be extra affected relying on when the road is restarted.

READ MORE: Gas costs in southern Ontario to fall one other 4 cents/litre Thursday, analyst says

The spill in Kansas happened downstream from a key junction in Steele City, Nebraska, the place Keystone splits to run into Illinois. That stretch of the road may very well be restarted, however the different phase affected by the spill won’t come again till regulators approve a restart.

By distinction, Gulf Coast refiners can draw on extra sources for crude, each from offshore Louisiana amenities and from nations like Colombia, Mexico and Ecuador.

Still, volumes to the Gulf from Cushing have already dropped. Volumes on TC Energy’s Marketlink pipeline, which flows from Cushing to Nederland, Texas, fell by about 300,000 bpd to lower than 500,000 bpd, Wood Mackenzie estimates, after the leak was found.

That might go away the Gulf Coast refineries in need of heavy Canadian barrels.

U.S. bodily crude oil grade costs had been blended on Thursday and O’Donnell at East Daley Capital mentioned he expects volatility to proceed so long as Keystone remained offline.

Meanwhile, a prolonged shutdown of the pipeline might result in Canadian crude getting bottlenecked in Alberta, and drive costs decrease, though the market’s response on Friday was muted.

Western Canada Select (WCS), the benchmark Canadian heavy grade, for December supply final traded at a reduction of $27.70 per barrel to the U.S crude futures benchmark, in keeping with a Calgary-based dealer. On Thursday, December WCS traded as little as $33.50 below U.S. crude, earlier than settling at round a $28.45 low cost.

“I am shocked by the size of the spill and I’m shocked at the lack of market price reaction,” mentioned Paul Sankey, an analyst at unbiased analysis agency Sankey Research.

(Reporting by Arathy Somasekhar in Houston, Laura Sanicola in Washington, Nia Williams in Calgary and Shariq Khan in Bengaluru; Editing by Marguerita Choy)