Officials: China real estate recovering from debt crackdown

BEIJING –

China’s huge actual property trade is recovering from a stoop triggered by tighter debt controls, a deputy central financial institution governor mentioned Friday, after a wave of defaults by builders rattled international monetary markets.

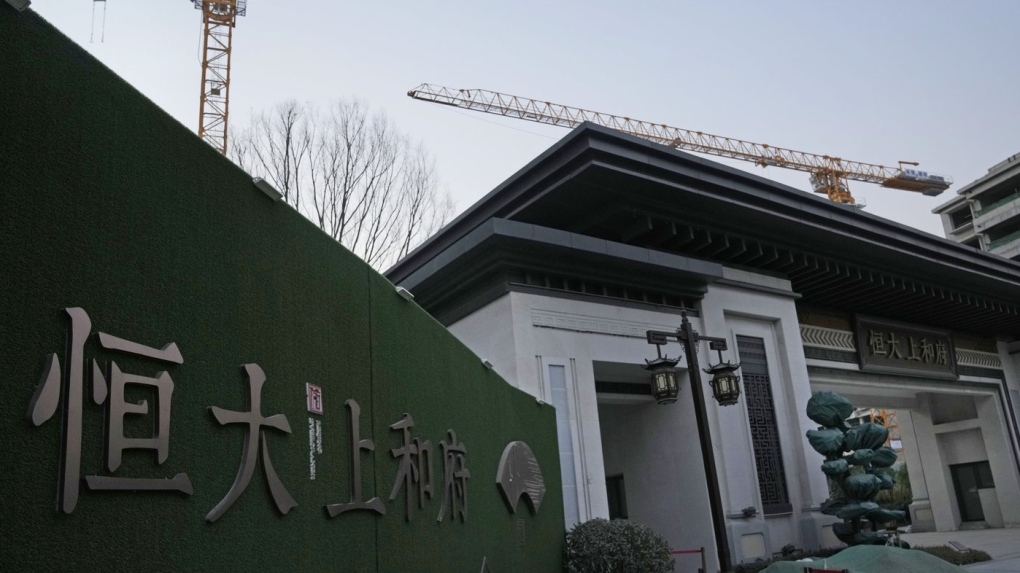

Pan Gongsheng talked about Evergrande Group, the worldwide trade’s most closely indebted developer, however gave no replace on its government-supervised efforts to restructure 2.1 trillion yuan ($305 billion) in debt to banks and bondholders.

“Market confidence is recovering. Transaction activity in the real estate market has increased,” mentioned Pan at a news convention forward of the assembly of China’s legislature. “The financing environment, especially for high-quality enterprises, has improved significantly.”

Pan gave no indication Beijing deliberate vital adjustments in its debt controls, referred to as “three red lines.”

China’s financial development slid in mid-2021 after regulators who fear debt ranges are dangerously excessive blocked Evergrande and different closely indebted builders from borrowing more cash. That added to disruption from anti-virus controls.

Some builders collapsed and others defaulted on billions of {dollars} of money owed to Chinese and overseas bond buyers. Evergrande has mentioned it has 2.3 trillion yuan ($330 billion) in belongings however was struggling to transform that into money to repay lenders.

Local governments took over some unfinished tasks to verify households bought residences that already have been paid for.

In the ultimate quarter of 2022, bond gross sales by builders rose 22% in contrast with a yr earlier to 120 billion yuan ($17.5 billion), based on Pan. He mentioned financial institution loans for actual property growth additionally elevated.

Meanwhile, the central financial institution governor mentioned Beijing plans to maintain the politically delicate trade price of its yuan steady after it tumbled to a 14-year low towards the U.S. greenback in September.

The trade price “will remain basically stable at a reasonable and balanced level,” Yi Gang mentioned on the occasion with Pan.

The central financial institution intervened to cease the yuan’s slide after merchants shifted cash into {dollars} to revenue from Federal Reserve rate of interest hikes.

The trade price would possibly face additional stress as a result of extra U.S. price hikes are anticipated to chill financial exercise and stubbornly excessive inflation whereas Beijing is easing lending controls to shore up sluggish financial development.

A weaker yuan helps Chinese exporters by making their items cheaper for overseas patrons, but it surely encourages capital to movement overseas. That raises borrowing prices in China.

The People’s Bank of China permits the yuan to commerce inside a slim band round a price set every morning. The central financial institution has tried to enhance the monetary system’s effectivity by making that mechanism extra versatile however has backtracked to cease huge adjustments within the trade price.

Yi, a former economics professor at Indiana University, and different People’s Bank leaders are due to get replaced this month in a once-a-decade change of presidency that may set up supporters of Chinese chief Xi Jinping in key financial posts.

Yi famous the yuan has fallen beneath the symbolically vital degree of seven to the greenback 3 times.

“The stability of economic and social expectations is very important,” he mentioned.