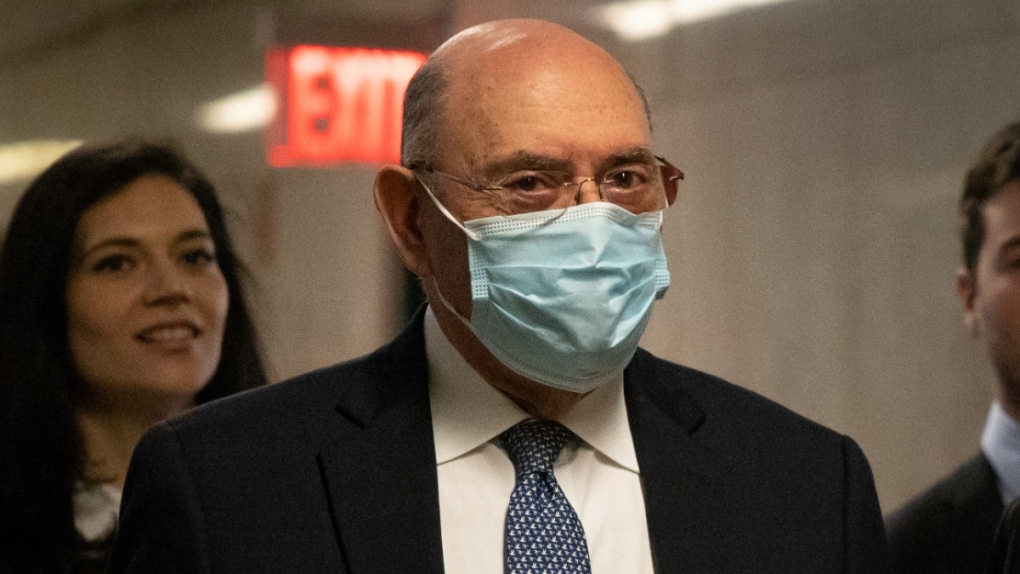

Donald Trump’s longtime CFO faces sentencing for tax fraud scheme

NEW YORK –

Allen Weisselberg, a longtime government for Donald Trump’s actual property empire whose testimony helped convict the previous president’s firm of tax fraud, is ready to be sentenced Tuesday for dodging taxes on US$1.7 million in job perks.

New York Judge Juan Manuel Merchan is anticipated to condemn Weisselberg, a senior Trump Organization adviser and former chief monetary officer, to 5 months in jail, in step with a plea settlement reached in August.

Weisselberg, 75, was promised that sentence when he agreed to plead responsible to fifteen tax crimes and testify towards the corporate, the place he is labored for the reason that mid-Nineteen Eighties.

When he begins serving his sentence, Weisselberg is anticipated to be locked up at New York City’s infamous Rikers Island jail advanced. He can be eligible for launch after little greater than three months if he behaves behind bars.

As a part of his plea settlement, Weisselberg should additionally pay practically $2 million in taxes, penalties and curiosity, which he stated he has made vital progress paying. He should additionally full 5 years of probation.

Weisselberg confronted the prospect of as much as 15 years in jail — the utmost punishment for the highest grand larceny cost — if he had been to have reneged on the deal or if he did not testify in truth on the Trump Organization’s trial. He is the one individual charged within the Manhattan district legal professional’s three-year investigation of Trump and his business practices.

Weisselberg testified for 3 days, providing a glimpse into the internal workings of Trump’s actual property empire. Weisselberg has labored for Trump’s household for practically 50 years, beginning as an accountant for his developer father, Fred Trump, in 1973 earlier than becoming a member of Donald Trump in 1986 and serving to broaden the household firm’s focus past New York City into a world golf and lodge model.

Weisselberg advised jurors he betrayed the Trump household’s belief by conspiring with a subordinate to cover greater than a decade’s value of extras from his revenue, together with a free Manhattan residence, luxurious automobiles and his grandchildren’s non-public faculty tuition. He stated they fudged payroll information and issued falsified W-2 kinds.

A Manhattan jury convicted the Trump Organization in December, discovering that Weisselberg had been a “high managerial” agent entrusted to behave on behalf of the corporate and its numerous entities. Weisselberg’s association diminished his personal private revenue taxes but additionally saved the corporate cash as a result of it did not must pay him extra to cowl the price of the perks.

Prosecutors stated different Trump Organization executives additionally accepted off-the-books compensation. Weisselberg alone was accused of defrauding the federal authorities, state and metropolis out of greater than $900,000 in unpaid taxes and undeserved tax refunds.

The Trump Organization is scheduled to be sentenced on Friday and faces a high quality of as much as $1.6 million.

Weisselberg testified that neither Trump nor his household knew concerning the scheme because it was occurring, choking up as he advised jurors: “It was my own personal greed that led to this.” But prosecutors, of their closing argument, stated Trump “knew exactly what was going on” and that proof, reminiscent of a lease he signed for Weisselberg’s residence, made clear “Mr. Trump is explicitly sanctioning tax fraud.”

A Trump Organization lawyer, Michael van der Veen, has stated Weisselberg concocted the scheme with out Trump or the Trump household’s data.

Weisselberg stated the Trumps remained loyal to him at the same time as the corporate scrambled to finish a few of its doubtful pay practices following Trump’s 2016 election. He stated Trump’s eldest sons, entrusted to run the corporate whereas Trump was president, gave him a $200,000 elevate after an inner audit discovered he had been lowering his wage and bonuses by the price of the perks.

Though he’s now on a depart of absence, the corporate continues to pay Weisselberg $640,000 in wage and $500,000 in vacation bonuses. It punished him solely nominally after his arrest in July 2021, reassigning him to senior adviser and shifting his workplace.

He even celebrated his seventy fifth birthday at Trump Tower with cake and colleagues in August, simply hours after finalizing the plea settlement that ushered his transformation from loyal government to prosecution witness.

Rikers Island, a compound of 10 jails on a spit of land within the East River, simply off the principle runway at LaGuardia Airport in Queens, has been plagued in recent times by violence, inmate deaths and staggering staffing shortages.

Though simply 5 miles (8 kilometres) from Trump Tower, it is a veritable world away from the lifetime of luxurious Weisselberg schemed to construct — a far cry from the gilded Fifth Avenue workplaces the place he hatched his plot and the Hudson River-view residence he reaped as a reward.