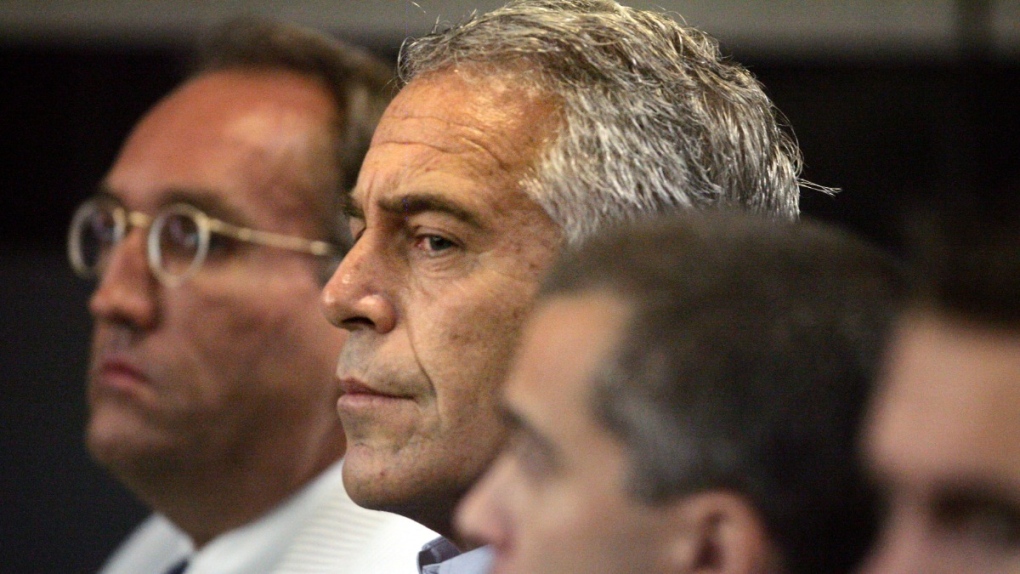

Deutsche Bank to pay US$75 million to settle lawsuit from Epstein victims, lawyers say

LONDON –

Deutsche Bank has agreed to pay US$75 million to settle a lawsuit claiming that the German lender ought to have seen proof of intercourse trafficking by Jeffrey Epstein when he was a shopper, based on attorneys for girls who say they have been abused by the late financier.

A girl solely recognized as Jane Doe sued the financial institution in federal district court docket in New York and sought class-action standing to characterize different victims of Epstein. The lawsuit asserted that the financial institution knowingly benefited from Epstein’s intercourse trafficking and “chose profit over following the law” to earn thousands and thousands of {dollars} from the businessman.

One of the regulation companies representing girls within the case, Edwards Pottinger, mentioned it believed it’s the largest intercourse trafficking settlement with a financial institution in U.S. historical past.

“The settlement will allow dozens of survivors of Jeffrey Epstein to finally attempt to restore their faith in our system knowing that all individuals and entities who facilitated Epstein’s sex-trafficking operation will finally be held accountable,” the agency mentioned in assertion.

Deutsche Bank wouldn’t touch upon the settlement Thursday however famous a 2020 assertion from the financial institution acknowledging its mistake in taking over Epstein as a shopper, mentioned Frank Hartmann, the German lender’s international head of media relations.

“The Bank has invested more than 4 billion euros ($4.3 billion) to bolster controls, processes and training, and hired more people to fight financial crime,” Hartmann mentioned in a written assertion.

The Boies Schiller Flexner regulation agency, which additionally represents plaintiffs, referred to as the settlement an essential step for victims’ rights.

“The scope and scale of Epstein’s abuse, and the many years it continued in plain sight, could not have happened without the collaboration and support of many powerful individuals and institutions,” David Boies, the agency’s chairman, mentioned in an announcement.

Deutsche Bank had beforehand joined JPMorgan Chase, which can be dealing with a lawsuit over its ties to Epstein, in preventing the allegations. Epstein killed himself in jail whereas dealing with federal felony fees of sexually abusing dozens of underage women.

The German lender mentioned late final yr that it offered “routine banking services” to Epstein from 2013 to 2018 and that the lawsuit “does not come close to adequately alleging that Deutsche Bank … was part of Epstein’s criminal sex trafficking ring.”

The lawsuits — which additionally goal the federal government of the U.S. Virgin Islands, the place Epstein had an property — are drawing in some high-profile figures.

A U.S. decide determined final month that JPMorgan Chase CEO Jamie Dimon should resist two days of questioning by attorneys dealing with the lawsuits.

The Virgin Islands authorities is also making an attempt to subpoena billionaire Elon Musk as a part of its personal litigation towards JPMorgan, accusing the banking big of enabling Epstein’s recruiters to pay victims and serving to conceal his a long time of intercourse abuse.

JPMorgan has denied the allegations and in flip has sued former govt Jes Staley, saying he hid Epstein’s abuse and trafficking to maintain the financier as a shopper. A lawyer for Staley had no touch upon the lawsuit when it was filed in March.