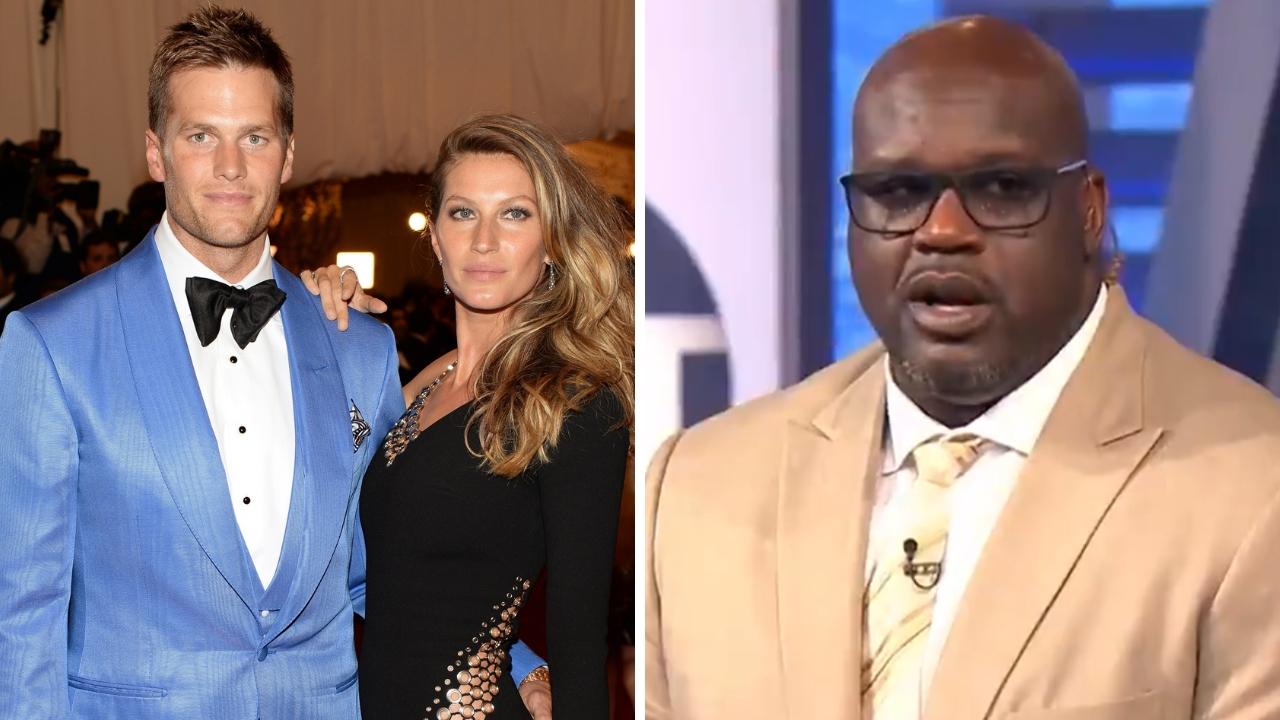

Shaq, Brady among crypto endorses sued over $47b deception ‘scheme’

Investors not solely are suing Sam Bankman-Fried, but additionally superstar endorsers of his bankrupt crypto firm FTX, together with Tom Brady, ex-wife Gisele Bündchen and comedy legend Larry David.

The embattled founder behind the collapsed $US32 billion ($A47 billion) cryptocurrency change faces prison investigation within the Bahamas and a possible journey to the US for questioning over the disappearance of billions of {dollars} in buyer funds.

Lawyers, together with star litigator David Boies, filed the lawsuit on behalf of Edwin Garrison, an Oklahoma resident who had an FTX yield-bearing account which he funded with crypto belongings to earn curiosity, and others like him, The New York Post experiences.

The record of superstar endorsers, which incorporates baseball star David Ortiz, NBA star Steph Curry and basketball icon Shaquille O’Neal, are accused of participating in misleading practices to promote FTX yield-bearing digital forex accounts, the go well with claims.

Celebrity endorsers had been concerned in a Super Bowl commercial for FTX.

Watch a median of 9 LIVE NBA Regular Season video games per week on ESPN on Kayo Sports on ESPN on Kayo Sports. New to Kayo? Start your free trial now >

“Part of the scheme employed by the FTX Entities involved utilising some of the biggest names in sports and entertainment … pouring billions of dollars into the Deceptive FTX Platform to keep the whole scheme afloat,” the lawsuit states.

Other massive names listed as defendants within the lawsuit embody “Shark Tank” investor Kevin O’Leary, Jacksonville Jaguars quarterback Trevor Lawrence, tennis participant Naomi Osaka and Miami Heat star Udonis Haslem.

Bankman-Fried, whose web value was valued as excessive as $17 billion at one level, is now broke — a stunning fall from grace for somebody as soon as broadly hailed as a genius within the cryptocurrency trade.

When the crypto change faltered on liquidity issues, US traders sustained $11 billion in damages, the lawsuit alleges.

The proposed class motion filed late Tuesday in Miami alleges that FTX yield-bearing accounts had been unregistered securities that had been unlawfully bought within the US.

FTX had entered into quite a few sports-related offers, a few of that are crumbling. The NBA’s Miami Heat and Miami-Dade County determined Friday to terminate their relationship with FTX, and can rename the workforce’s area.

Earlier on Friday, Mercedes mentioned it will instantly take away FTX logos from its Formula One vehicles.

FTX was “ultimately a Ponzi scheme, misleading customers and prospective customers with the false impression that any cryptocurrency assets held on the Deceptive FTX Platform were safe and were not being invested in unregistered securities,” the lawsuit states.

Brady and Bündchen, who additionally appeared in commercials touting FTX, purchased fairness stakes within the firm, which was pressured to file for chapter safety final week after it was realized that buyer deposits had been getting used to make dangerous bets by way of a subsidiary analysis agency.

Meanwhile, Bankman-Fried might be in scorching water with federal investigators. Sources conversant in the matter advised Bloomberg News that US and Bahamian authorities have been discussing presumably extraditing the 30-year-old Bankman-Fried, whose firm relies within the Bahamas, stateside.

Bankman-Fried is claimed to be co-operating with investigators within the Bahamas. It is probably going that he can be introduced again to the US for questioning, although it’s untimely to debate any doable prison costs, in line with Bloomberg.

After FTX filed for chapter, Bankman-Fried took to Twitter and mentioned he was “shocked to see things unravel the way they did.”

Customers fled the change over fears about whether or not FTX had ample capital, and it agreed to promote itself to rival crypto change Binance. But the deal fell by way of whereas Binance’s due diligence on FTX’s stability sheet was nonetheless pending.

FTX had valued its belongings between $10 billion to $50 billion, and listed greater than 130 affiliated corporations world wide, in line with its chapter submitting.

— This story initially appeared on nypost.com and has been republished with permission