Magna shares plunge after disappointing Q4 results: ‘Another difficult year’ | 24CA News

Shares of Magna International Inc. have been down nearly 15 per cent in late-morning buying and selling Friday as the corporate reported monetary outcomes that got here in under expectations.

“2022 was another difficult year for the automotive industry and for Magna,” mentioned firm chief government Swamy Kotagiri on an earnings name with analysts.

Supply disruptions that have been anticipated to have cleared up final yr didn’t, resulting in continued volatility in auto manufacturing that made for vital inefficiencies in Magna’s operations, he mentioned.

The mixture of last-minute manufacturing stops at its automaker prospects, working underperformance at some services, and better guarantee bills contributed to a squeeze in fourth quarter margins, mentioned Kotagiri.

Read extra:

Magna International to purchase Veoneer’s energetic security business for US$1.525 billion

Read subsequent:

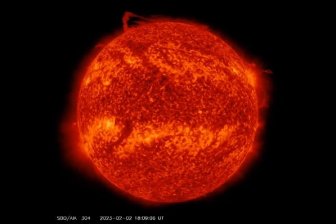

Part of the Sun breaks free and types a wierd vortex, baffling scientists

“Unfortunately, we ended a difficult year with disappointing Q4 results relative to our expectations entering the quarter.”

The auto elements firm, which retains its books in U.S. {dollars}, says it earned US$95 million or 33 cents per share within the quarter ended Dec. 31, down from US$464 million or US$1.54 per diluted share within the final three months of 2021.

Sales totalled US$9.57 billion, up from US$9.11 billion a yr earlier.

On an adjusted foundation, Magna mentioned it earned 91 cents per diluted share within the fourth quarter of 2022, down from an adjusted revenue of US$1.30 per diluted share in the identical quarter a yr earlier.

Analysts on common had anticipated a revenue of US$1.02 per share, in response to estimates compiled by monetary markets information agency Refinitiv.

The firm’s margin on earnings earlier than curiosity and taxes declined to three.7 per cent for the fourth quarter, whereas in November it had revised down its margin expectations to between 4.8 per cent and 5 per cent for the yr. The decrease margins led to free money circulation that was additionally got here in under its outlook.

The outcomes helped push the corporate’s share worth down $12.85, or 14.8 per cent, in mid-morning buying and selling on the Toronto Stock Exchange.

Looking forward, Magna doesn’t count on a fast restoration as margins for 2023 are anticipated someplace within the wide selection of between 4.1 per cent and 5.1 per cent, in contrast with 5.6 per cent within the fourth quarter of 2021.

The firm expects higher enhancements by 2025, with margins of between 6.7 and seven.8 per cent, when manufacturing volatility and different pressures are anticipated to have eased.

“We are hoping that the market stabilizes,” mentioned Kotagiri.

© 2023 The Canadian Press