Donald Trump paid no income tax in 2020, reported losses in office, records show

Donald Trump paid no revenue tax in the course of the closing full yr of his presidency as he reported a loss from his sprawling business pursuits, in line with tax figures launched by a congressional panel.

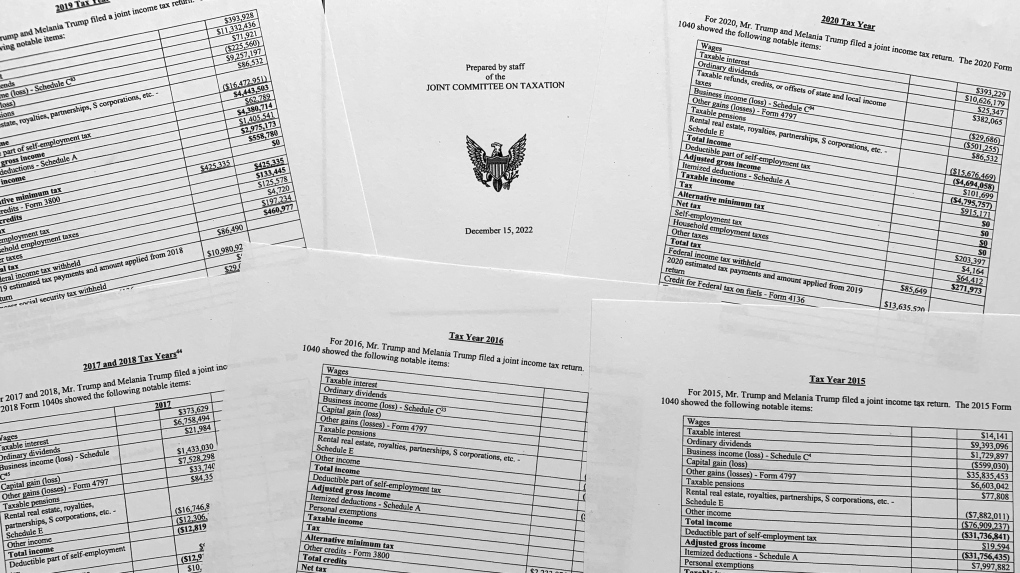

The data, launched late on Tuesday by the Democratic-led House of Representatives Ways and Means Committee after a years-long combat, present that Trump’s revenue, and his tax legal responsibility, fluctuated dramatically throughout his 4 years within the White House.

The data lower towards the Republican ex-president’s long-cultivated picture as a profitable businessman as he mounts one other bid for the White House.

Trump and his spouse, Melania, paid some type of tax throughout all 4 years, the paperwork confirmed, however have been in a position to decrease their revenue taxes in a number of years as revenue from Trump’s companies was greater than offset by deductions and losses.

The committee questioned the legitimacy of a few of these deductions, together with one for US$916 million, and members mentioned on Tuesday the tax returns have been quick on particulars. The panel is anticipated to launch redacted variations of his full returns in coming days.

Trump refused to make his tax returns public throughout his two presidential bids and his marketing campaign for workplace, although all different major-party presidential candidates have completed so for many years.

The committee obtained the data after a years-long combat and voted on Tuesday to make them public.

A Trump spokesman mentioned the discharge of the paperwork was politically motivated.

“If this injustice can happen to President Trump, it can happen to all Americans without cause,” Trump Organization spokesman Steven Cheung mentioned on Wednesday.

Democrats on the panel mentioned their evaluate discovered that tax authorities didn’t correctly scrutinize Trump’s complicated tax returns to make sure accuracy.

Though the U.S. Internal Revenue Service is meant to audit presidents’ tax returns annually, it didn’t accomplish that till Democrats pressed for motion in 2019.

The IRS assigned just one agent to the audit more often than not, the panel discovered, and didn’t look at a few of the deductions claimed by Trump.

The IRS declined to remark.

Prior to taking workplace, Trump reported heavy losses for a few years from his business to offset a whole lot of hundreds of thousands of {dollars} in revenue, in line with media reviews and trial testimony about his funds.

The paperwork launched by the committee confirmed that sample continued throughout his time within the White House.

During that point Trump and his spouse have been answerable for self-employment and family employment taxes. As a outcome, they paid a complete of US$3 million in taxes over these 4 years.

But deductions enabled them to reduce their revenue tax legal responsibility in a number of years.

In 2017, Trump and his spouse reported adjusted gross revenue of destructive US$12.9 million, resulting in a web revenue tax of US$750, the data confirmed.

They reported adjusted gross revenue of US$24.3 million in 2018 and paid a web tax of $1 million, whereas in 2019 they reported US$4.4 million of revenue in 2019 and paid US$134,000 in taxes.

In 2020, they reported a lack of US$4.8 million and paid no web revenue tax.

Reporting by Andy Sullivan in Washington Additional reporting by Doina Chiacu in Washington Editing by Scott Malone and Matthew Lewis