The State of Commercial Real Estate in Canada – Canadian Business – How to Do Business Better

From a transactional standpoint, notably for investments, it was one of many slowest years we’ve had in a very long time. Inflation and subsequent rate of interest will increase prompted a way of uncertainty throughout world actual property markets. Canadians spent a lot of the 12 months asking whether or not rates of interest would maintain rising, and questioning what the consequences of those elevated charges can be.

The previous 18 months have witnessed the impression of those rises, sending ripples by way of the industrial actual property (CRE) cap charge panorama—intricately influencing property valuation processes, dampening transactional actions, and curbing landowners’ enthusiasm for buying new properties or initiating recent developments. As actual property inherently operates in cycles, we discover ourselves navigating a transitional interval, adapting to the enduring presence of elevated rates of interest as we flip the web page to 2024.

A recession’s impression on the nationwide market

Statistics Canada reported that the nationwide economic system shrank within the third quarter by 0.3 per cent. The information company’s previous report confirmed a slight retraction within the earlier quarter too, however these figures have since been up to date to indicate 0.3 per cent development final spring. Whether we’re on the verge of a recession or within the thick of it, there are some issues to think about.

In occasions like these, occupiers often pull again on growth plans, which is able to proceed to drive up vacancies. We’ve been seeing this development already, notably within the expertise sector.

A recession might also begin to shift the steadiness of energy again in the direction of employers as staff face extra competitors in a labour market that’s shedding jobs. Research has proven that managers are extra desirous about rising in-office occupancy than their staff, so with extra decision-making confidence, we may see larger workplace use, which may counteract the consequences of some corporations wishing to cut back their footprints.

The largest potential impression of a recession can be a discount in rates of interest. Economists from Benjamin Tal to David Rosenberg have predicted a big discount in charges over the following two years. Lower charges would reactivate the funding and lending markets, serving to offset a number of the anticipated will increase in cap charges. When, and how briskly that occurs is up for debate.

Managing misery

Higher debt masses, rates of interest and a scarcity of liquidity imply Canada will expertise misery. While some corporations might be challenged, offers will speed up as organizations rebalance their portfolios and discover strategic methods to climate the storm. We’ll witness corporations fade, startups emerge and consolidation happen in each the non-public and public actual property markets. Promisingly, innovation and motion are a byproduct of laborious occasions and a wholesome and important step in restarting the following cycle.

Reconfiguring the workplace market

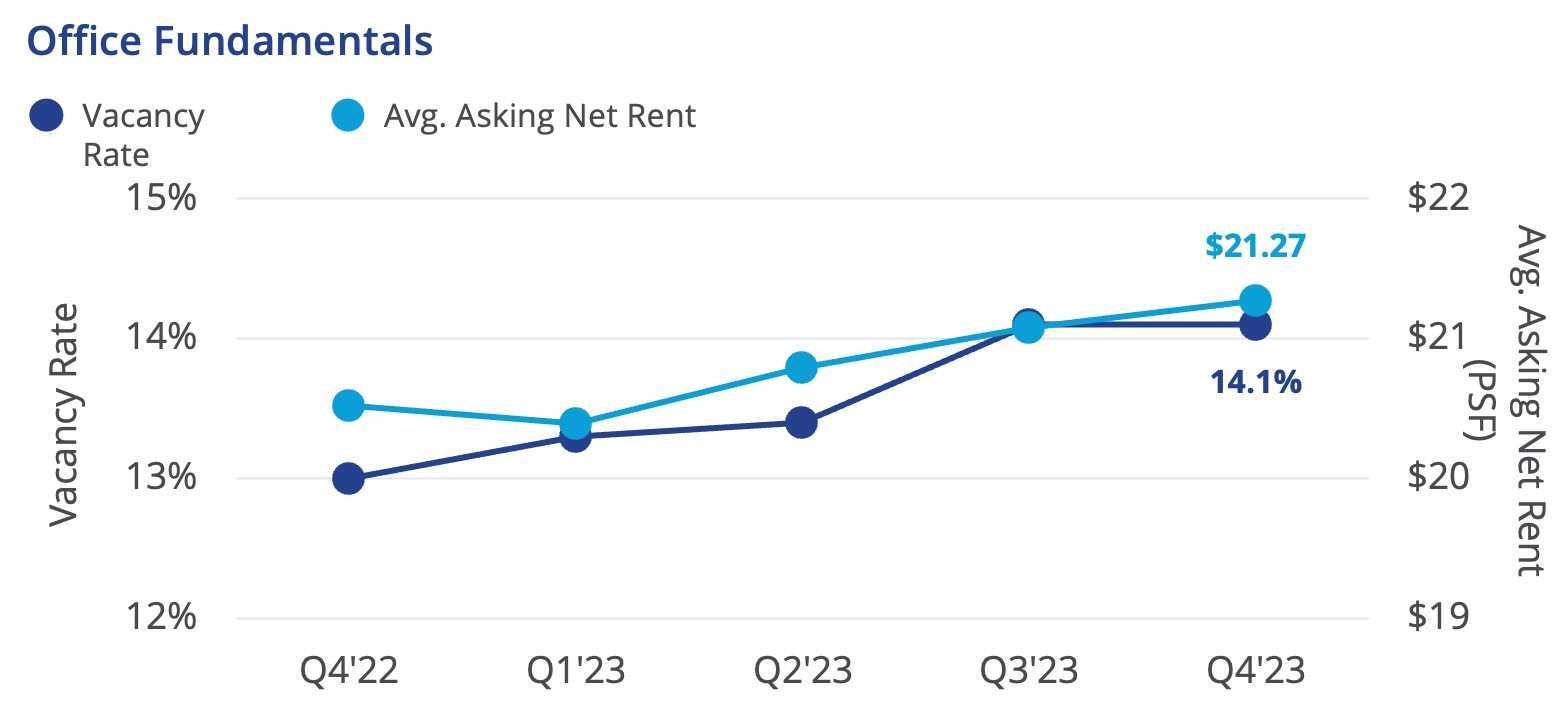

By the ultimate quarter of 2023, nationwide workplace emptiness, together with downtown and suburban markets, had flattened to 14.1%, based on Colliers’ National Market Snapshot This fall. Office emptiness has been climbing during the last three years and can probably proceed to rise at a decelerated charge within the quick time period.

Hybrid work has taken maintain in Canada, however hybrid working doesn’t imply 100% distant. Companies are clarifying their in-office work insurance policies and we’ve discovered {that a} mixture of mandated in-office days, availability of various workspaces, and methods that assist to cut back commute occasions and prices all assist contribute to extra in-office time. Daily occupancy continues to be beneath 2019 ranges, however indicators are pointing to a gradual improve over time.

The shifting workplace situations additionally present uncommon alternatives for tenants. Prior to the pandemic, the low emptiness ranges shut many corporations out of the marketplace for prime downtown places of work, proscribing them to lower-quality buildings. Now, corporations have the flexibility to relocate, increase or set up a presence in downtown workplace house at extra aggressive lease charges or with beneficial incentives.

We are seeing a flight to high quality and a push in the direction of bolstering facilities inside buildings and the encircling ecosystems. “Earning the commute” is more and more essential in traffic-heavy cities like Toronto, and making a bustling downtown ecosystem is a key instrument to create incentives to return to the workplace. For instance, in Vancouver, downtown workplace emptiness lowered barely to 11.8% on the finish of 2023 with most absorption happening in the direction of the tip of the 12 months.

Generating confidence

In occasions of uncertainty, shoppers flip to their actual property service suppliers as advocates to assist information them with routes to restoration. At Colliers, we wish to say that “experts choose experts.” Through numerous business streams together with design, improvement advisory, placemaking, property and venture administration, appraisal, capital markets and leasing, we consider in being enterprising to assist our shoppers each stay nimble and obtain long-term success.

Colliers, which has its origins in Vancouver, simply marked its 125th anniversary. Over the a long time, we’ve confronted many challenges together with each World Wars, pandemics, the Depression and recessions — and we’ve supported shoppers by way of the low factors whereas producing worth, generally in sudden methods and locations.

Improving variety

It’s important for the CRE business to speed up the tempo of diversifying its workforce. We’ve improved this extra within the final 15 years than within the earlier 40 years, however extra work have to be executed to evolve our expertise rosters to welcome extra expertise from marginalized communities. Canada is a rustic constructed on variety, and accessing all of the expertise, views and experiences will strengthen our business and higher allow us to assist shoppers.

The first step to progress on this entrance is measuring demographics as a company as a result of for those who can’t establish your shortcomings, you’ll be able to’t allow change. This have to be adopted up with a dedication to focus much less on hiring, and extra on recruiting. Our business should broaden our recruiting base into totally different colleges, communities, organizations, cultures and industries. Deepening and diversifying our expertise pool might be essential to fulfill the challenges of what lies forward.

Keeping issues in perspective

As we exit a 12 months underscored by uncertainty and put together to face the challenges of a possible recession, misery and a shifting workplace market, it’s essential to acknowledge this as a part of a well-recognized cycle. There is loads of work to do, however Canadian industrial actual property continues to have a powerful, long-term outlook supported by optimistic macro traits, like giant immigration targets, a constant labour market, a secure authorities and a monitor report of GDP development.

As the near-term outlook comes into focus, we’re well-positioned for a return to power as we depart the lingering feeling of uncertainty behind.