What happened when UPS lost an Ontario family’s $14K down payment on a Newfoundland home | 24CA News

Last week, Sherrie Wynne was distraught and crying, occupied with how her efforts to purchase a house in Newfoundland and Labrador practically value her a part of her life financial savings, her job and the roof over her head — all due to a UPS package deal misplaced within the mail.

“I’ve been in tears, this was everything,” the 39-year-old St. Catharines, Ont., girl advised 24CA News.

“My whole house was in this package that they wouldn’t talk to me about and had lost,” she stated, referring to the financial institution draft she despatched by courier to safe the acquisition of the brand new house.

After the package deal was unaccounted for, the sellers of the house advised Wynne they’d be affected person, however could not wait too lengthy.

UPS finally discovered the financial institution draft — after a nail-biting eight days — however as one shopper safety advocate says, Wynne’s story reveals the vulnerability of counting on a courier system for vital paperwork.

It’s additionally an instance of the emotional journey Canadians can face as they attempt to safe everlasting housing.

Finding the ‘good home’ on a funds

Wynne stated she bought her earlier house in 2017 after a divorce however did not web sufficient cash to purchase one other house in Ontario.

Two years later, Wynne and her present companion Jesse Vaters began saving up and on the lookout for houses in Newfoundland and Labrador with a worth level inside their means — round $60,000.

They each dwell and work as property managers at an condo constructing in St. Catharines.

Wynne stated they just lately discovered the “perfect house” sitting proper throughout from the ocean they usually made a suggestion.

“We decided to put in an offer with basically all of my life savings … it was a combination of a dream and a fall back because in this day and age, how are you going to retire?”

Wynne and Vaters despatched a $14,000 financial institution draft and authorized paperwork to a lawyer in Newfoundland and Labrador.

“We sent it all through UPS. UPS lost it,” Wynne stated.

“When they lost it, they refused to talk to me about any of it.”

‘I could not kind sentences from the stress’

Wynne stated if she had misplaced that cash and could not get it again, she would have been in a determined scenario.

She lives together with her companion, three youngsters and three pets.

Wynne stated she was additionally identified with a number of sclerosis in 2012 and realized a couple of cyst on her backbone in 2018, including that docs just lately advised her it seems to be rising.

Wynne is ready to do an MRI. If she wants surgical procedure and, in the long run could not transfer out east, she stated she would have misplaced her job and, because of this, her condo. Vaters cannot afford the lease on his personal, she added.

She additionally would not have been in a position to qualify for ODSP due to the cash she’s saved as much as purchase the house in Newfoundland. Asset limits are $40,000 for one particular person and $50,000 for {couples}.

“I couldn’t form sentences from the stress,” she stated.

Wynne contacted 24CA News whereas the financial institution draft was nonetheless misplaced, apprehensive she was about to lose all the things.

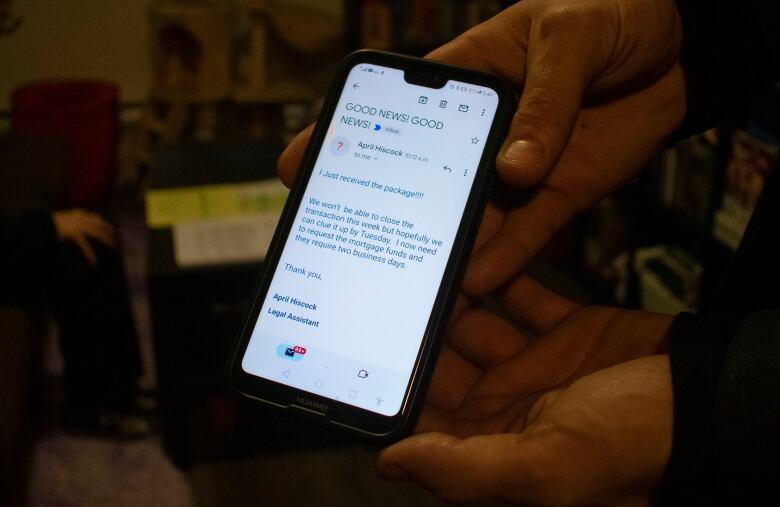

CBC Hamilton contacted UPS on Dec. 9 at 8 a.m. ET. Two hours later, Wynne stated she heard again from the corporate.

She stated they discovered and delivered the package deal. They blamed climate for the delay, Wynne stated.

UPS declined an interview, however an organization spokesperson stated it opened an investigation into the misplaced package deal, then discovered and delivered it.

“Customer service is important to us, and we take the delay of any package seriously,” learn the emailed assertion.

“We regret the stress and inconvenience this issue has caused the customer.”

Lawyer recommends wiring cash

Wynne and Vater have been overjoyed to listen to the news.

“We’re ecstatic it’s all there and taken care of, but we’re lucky,” she stated.

Wynne stated anybody else shopping for a house in a distinct province ought to strive different strategies like delivering it your self.

Jeff Orenstein, a lawyer with Consumer Law Group, advised 24CA News folks also needs to strive wiring the cash on to the lawyer, even when it prices a bit extra. He additionally stated Wynne would’ve been in a position to name her financial institution and cancel the financial institution draft and attempt to re-send it.

Wynne stated she had held off from calling her financial institution, Tangerine, whereas hoping the package deal can be discovered.

Tangerine spokesperson Rebecca Webster advised CBC Hamilton as long as the financial institution draft wasn’t cashed, Wynne might’ve cancelled it and signed an indemnity kind to make sure somebody would not money the unique draft.

In phrases of whether or not UPS can be answerable for dropping the package deal, Orenstein stated it is dependent upon the scenario.

He stated if somebody pays for specific transport, for instance, and the service delivers the package deal late, the corporate could also be liable.

“It seems to me the companies are taking on an obligation of result … they actually should deliver it when they promised they would, other than an act of god like a snowstorm,” he stated.

Wynne stated she’s wanting ahead to packing up, shifting into the brand new house and consuming contemporary lobster.

“It’s a Christmas present.… We’re excited, it’s good, it’ll be fun times,” she stated.

“I can see whales and jellyfish.”