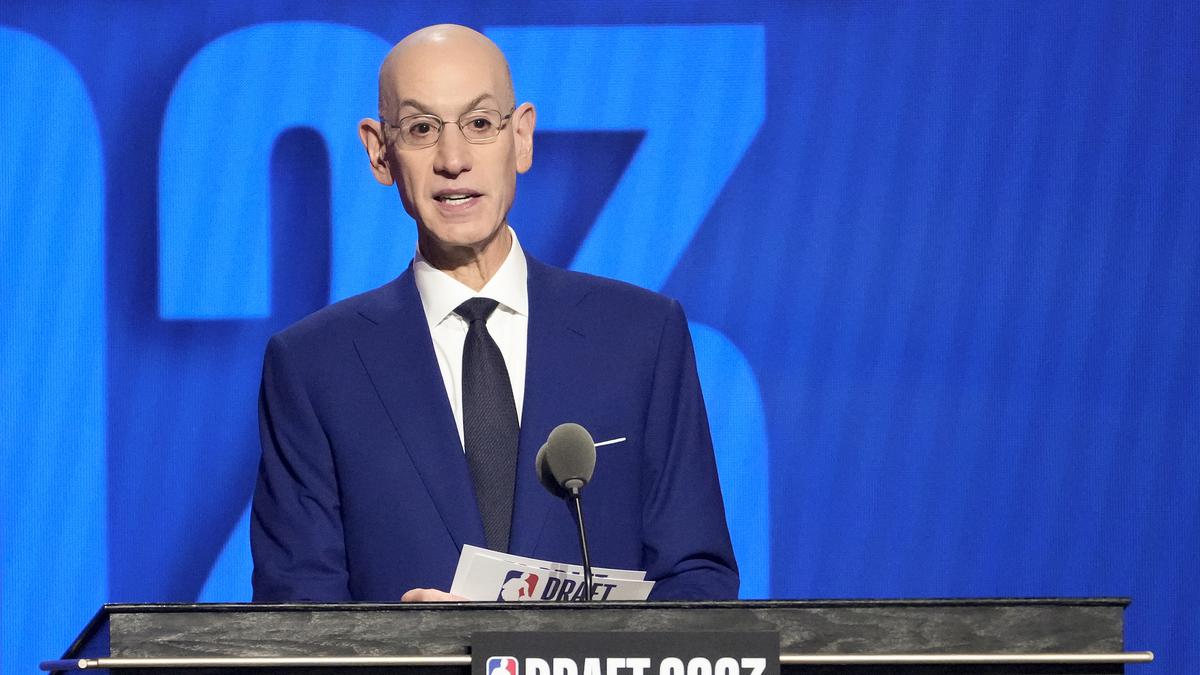

With sovereign wealth funds beginning to shovel cash into sports activities groups and leagues throughout the nation, NBA commissioner Adam Silver mentioned Monday that he doesn’t see any state-owned funding teams changing into the controlling proprietor of an NBA franchise anytime quickly.

Per the NBA’s funding guidelines, the controlling proprietor of an NBA franchise should personal at the very least 15 % of the franchise.

If a sovereign wealth fund desires to become involved, it should have a passive funding within the group that’s price not more than 5 %. A chief instance of that is the Qatar sovereign wealth fund, which final month agreed to buy a five-percent stake in Monumental Sports and Entertainment, the controlling proprietor of the Washington Wizards, the WNBA’s Washington Mystics and the NHL’s Washington Capitals.

Silver desires to ensure that people are those which are primarily governing groups, although.

READ: Wembanyama extra aggressive in stronger second Summer League recreation

“I don’t want to say what could ever happen, but there’s no contemplation right now,” Silver mentioned in Las Vegas. “I mean, it’s very important to us, putting aside sovereign wealth funds that individuals are in a position to control our teams, be responsible to the fans, be responsible to their partners and to the players.

“It’s very important to us that there be a person (in charge), and this is independent of sovereign wealth funds. I think that in terms of the connection with the community, the connection with the players and their other partners in the league.”

One of probably the most notable sovereign wealth funds because it pertains to the sports activities is Saudi Arabia’s Public Investment Fund, which funds LIV Golf. The PGA Tour created shockwaves throughout the golf world final month when it introduced it deliberate to enter a merger with LIV.