Nvidia close to becoming first trillion-dollar chip firm after stellar forecast

Nvidia Corp soared about 25 per cent on Thursday to close a market worth of US$1 trillion after its stellar forecast confirmed that Wall Street has but to cost within the game-changing potential of AI spending.

The surge added to an over two-fold rise within the inventory this 12 months and was set to extend the chip designer’s worth by about $190 billion to just about $945 billion. That is simply shy of the biggest one-day worth achieve for a U.S. agency, a report presently held by Apple Inc’s $190.90 valuation bounce on Nov. 10.

Nvidia’s rosy earnings additionally sparked a rally within the chip sector and AI-focused corporations, lifting inventory markets from Japan to Europe. In the U.S., firms together with Alphabet Inc, Microsoft Corp and AMD rose between 3% and 10%.

Analysts rushed to boost their value targets on Nvidia inventory, with 27 lifting their view on the concept that all roads in AI result in the corporate because it offers the chips used to energy ChatGPT and lots of comparable companies.

The imply value goal has greater than doubled this 12 months. At the very best view, a $600 value goal from Rosenblatt Securities and HSBC, Nvidia may have a worth of $1.48 trillion, greater than Amazon.com Inc, the fourth-most worthwhile U.S. firm.

“In the 15+ years we have been doing this job, we have never seen a guide like the one Nvidia just put up with the second-quarter outlook that was by all accounts cosmological, and which annihilated expectations,” Stacy Rasgon of Bernstein stated.

Nvidia, the fifth-most worthwhile U.S. firm, on Wednesday projected quarterly income greater than 50% above the typical Wall Street estimate and stated it could have extra provide of AI chips within the second half to satisfy a surge in demand.

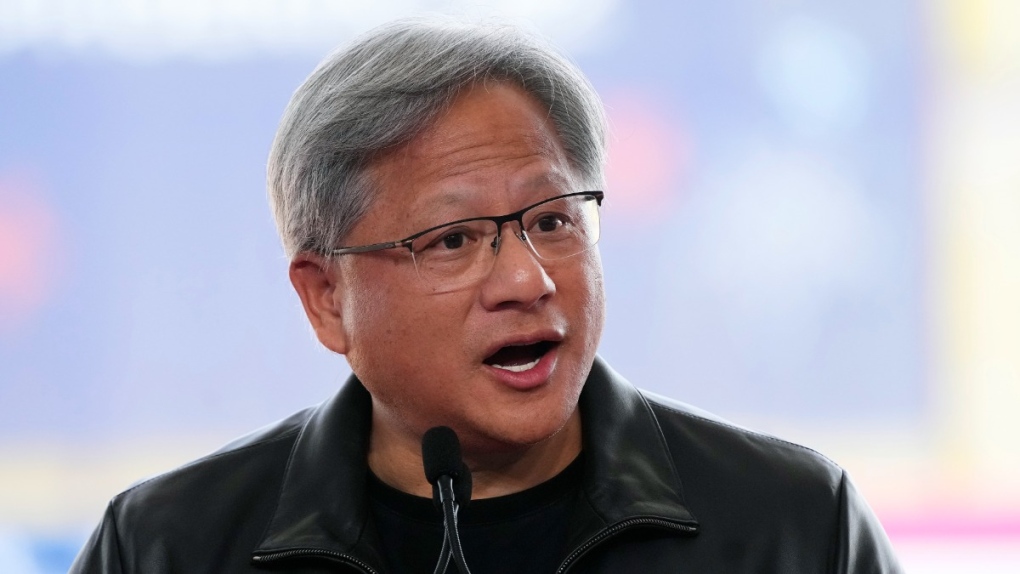

CEO Jensen Huang stated $1 trillion price of present gear in knowledge facilities must get replaced with AI chips, as generative AI is utilized into each product and repair.

The outcomes bode nicely for Big Tech firms, which have shifted focus to AI in hopes the know-how would assist entice demand at a time their revenue engines of digital promoting and cloud computing are beneath strain from a weak financial system.

“This Nvidia (forecast) changes the whole narrative around AI and demand looking ahead in the enterprise. Historical inflection point possibly in AI Revolution, with Nvidia the key barometer,” stated Dan Ives of Wedbush.

Reporting by Aditya Soni in Bengaluru; Editing by Rashmi Aich and Shounak Dasgupta