Why are Canadian banks quick to charge more for borrowing, but slow to increase savings account rates?

While Canada’s largest banks are charging extra to lend cash attributable to excessive rates of interest, specialists say they’re failing to extend financial savings account charges in an analogous approach.

“On the borrowing side, the banks are much quicker to pass that on to consumers,” Natasha Macmillan, the director of on a regular basis banking at Ratehub.ca, informed CTVNews.ca. “Unfortunately, however, on the saving side or on the deposit side, they’re less quick to pass that on.”

Aimed at taming inflation, the Bank of Canada started implementing a collection of rate of interest hikes in March 2022, from a historic low of 0.25 per cent to 4.5 per cent right this moment – the very best it has been since 2007. With the price of borrowing cash growing, it is sensible that banks have been fast to cost larger rates of interest for mortgages and loans.

“When the Bank of Canada increases its policy rate, it’s increasing the funding cost for banks,” Claire Celerier, an affiliate professor of finance on the University of Toronto’s Rotman School of Management, informed CTVNews.ca. “It’s quite normal for banks to transfer the increase in their funding cost to their loans and mortgage rates.”

But generally, banks haven’t been as fast to extend rates of interest for private financial savings accounts.

Macmillan from Ratehub, an internet site that compares monetary merchandise like mortgages and bank cards, notes that whereas financial savings account rates of interest have elevated considerably over the previous yr, they’re being outpaced by borrowing prices.

“It does tend to move at a bit of a slower rate, whereas on the borrowing side, it’s almost same day, next day kind of change, depending on the Bank of Canada announcements,” Macmillan defined.

Flush with money and posting income, banks usually are not aggressively chasing after new deposits, in keeping with Celerier.

“There is no bank advertising higher rates,” Celerier stated. “They have a lot of money in their balance sheets following the pandemic.”

Macmillan and Celerier additionally each suppose an absence of competitors and client apathy is protecting Canada’s largest banks from providing extra aggressive financial savings account charges.

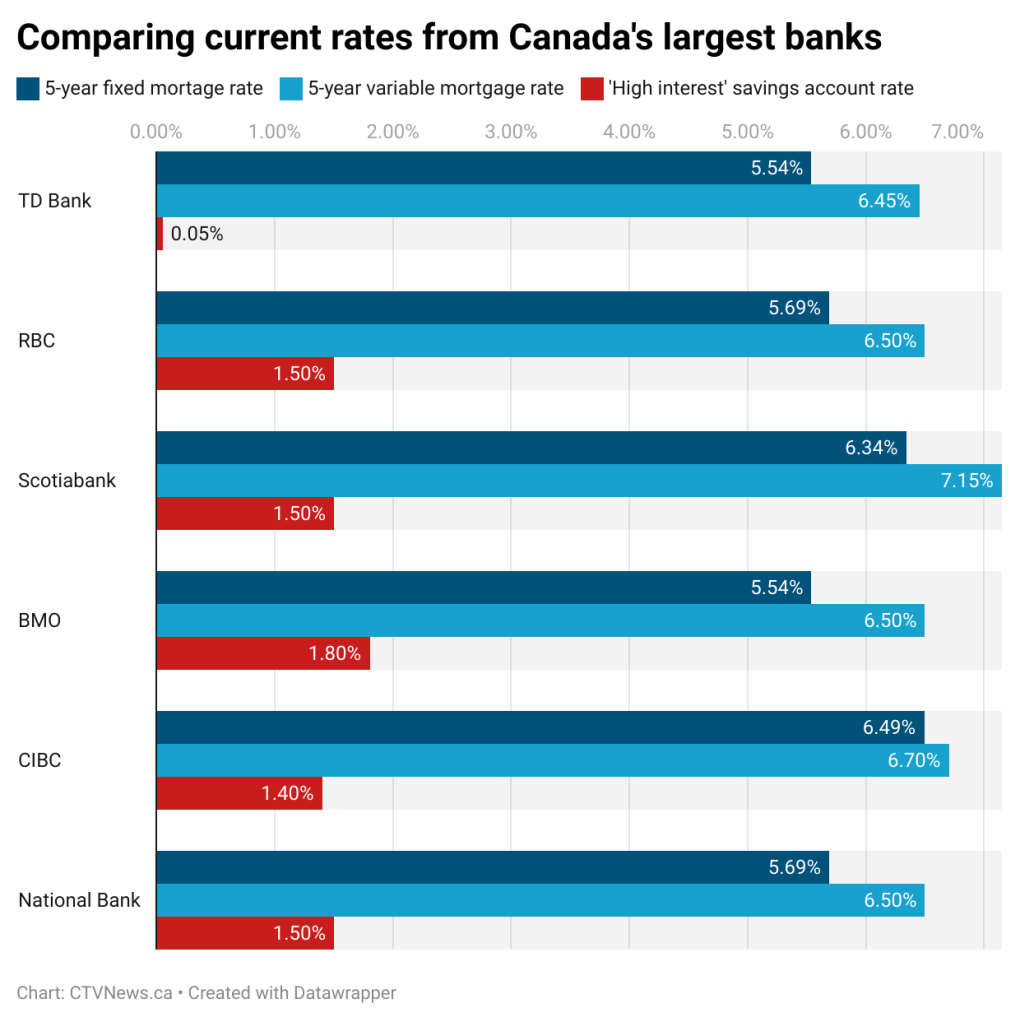

These banks promote “high interest” financial savings accounts with charges between 0.05 per cent at TD Bank and 1.8 per cent on the Bank of Montreal. Others fall between 1.4 and 1.5 per cent – figures that may be greater than double at smaller monetary establishments, in keeping with Ratehub.ca.

“There are definitely better saving rates in Canada outside of the big five,” Macmillan stated, referring to TD Bank, RBC, Scotiabank, BMO and CIBC. “It’s definitely recommended to shop around… as opposed to being stuck with the banks that we’re the most comfortable with or the most aware of.”

“There are definitely better saving rates in Canada outside of the big five,” Macmillan stated, referring to TD Bank, RBC, Scotiabank, BMO and CIBC. “It’s definitely recommended to shop around… as opposed to being stuck with the banks that we’re the most comfortable with or the most aware of.”

The rising discrepancy between borrowing and saving charges has led to stern phrases and motion from officers in nations together with Australia, South Korea and New Zealand.

“What we are calling out across the banks is they had been very quick to increase their mortgage lending rates, but deposit rates have lagged behind and bank margins are holding up,” the governor of the Reserve Bank of New Zealand stated throughout a February press convention. “High deposit rates are a critical part to encourage savings, which takes inflation pressure out of the economy.”

Canada’s Department of Finance didn’t reply to a request for remark.

CANADA’S LARGEST BANKS WEIGH IN

CTVNews.ca reached out to Canada’s six largest banks for explanations. TD Bank, CIBC, BMO and Scotiabank solely replied with normal statements highlighting services and products reminiscent of GICs, which have larger rates of interest than most financial savings accounts.

“The (Bank of Canada) rate is one reference point that RBC uses to set our Prime Rate and interest rates on home equity loans, but it is not the sole driver of RBC’s funding costs,” a Royal Bank of Canada spokesperson informed CTVNews.ca. “When considering changes to our prime rate and interest rates on deposits and home equity loans, we weigh a number of factors, including the competitive environment, risk exposure, our responsibility to clients and shareholders and our funding and regulatory costs.”

CTVNews.ca additionally acquired a response from the National Bank, which is Canada’s sixth largest financial institution.

“Rates for borrowing are notably pegged to the Bank of Canada policy rate that has been raised several times in the past few months. For that reason, mortgage rates have fluctuated,” a National Bank spokesperson defined. “On the other hand, rates on savings products are affected by a variety of factors, including product infrastructure and management costs as well as the ‘stickiness’ of the funds, in other words, the expected movements of the monies deposited.”

Despite low financial savings account rates of interest, specialists suppose many Canadians will doubtless follow their monetary establishment.

“It’s more just kind of the apathy of, are you comfortable setting up a new bank account or going through the paperwork associated with it,” Macmillan stated. “I think we’re at a time that it is definitely worth putting that time and investment forward to ensure that you can maximize your savings.”

With information from The Canadian Press