These are the new tax brackets for 2023

In 2022, Canadians skilled excessive inflation ranges as shifts within the world economic system started to settle. Canada’s tax brackets are listed and adjusted to account for inflation.

This implies that there are going to be some modifications as we transfer into 2023.

These modifications may affect the way you’re taxed whenever you file your 2023 revenue tax returns subsequent 12 months.

Below, I’ll define the brand new tax brackets for this 12 months and focus on another notable modifications that would have an effect on your private funds.

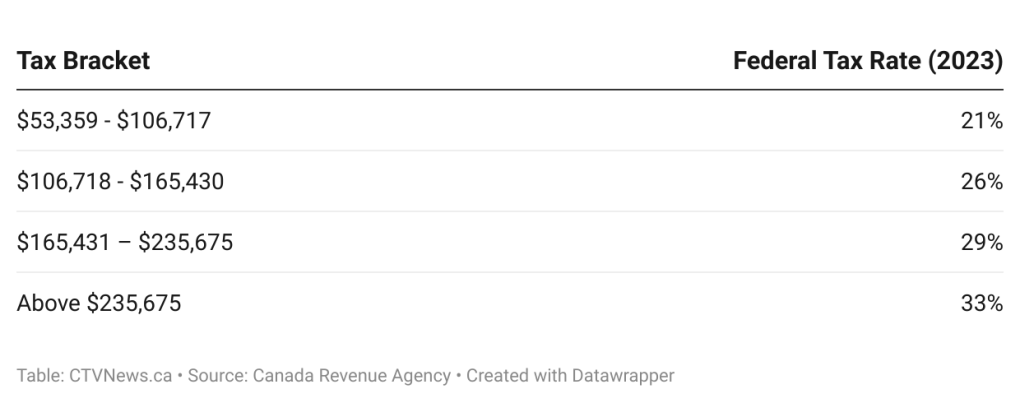

The new federal tax brackets for Canadians in 2023

In 2023, Canada’s federal tax brackets elevated by 6.3% to account for inflation.

Here are the tax brackets for 2023, as outlined by the CRA:

Any Canadians incomes lower than $53,359 in taxable revenue per 12 months (however above the primary private quantity of $15,000) will likely be topic to the base 15% tax price.

Why are Canada’s tax brackets altering?

Every 12 months, Canada incrementally modifications the federal revenue tax brackets to account for inflation. These tax charges, together with different advantages, tax credit, and funds, are listed to the inflation price. Since inflation elevated dramatically in 2022, the tax brackets noticed appreciable modifications and have been elevated by 6.3% for 2023.

As inflation rises, the price of client items sometimes will increase together with wages. Indexing tax brackets to inflation is an effective factor, because it reduces the quantity of taxes you pay. If tax brackets didn’t change to account for this, then folks can be paying a disproportionately excessive tax price primarily based on their revenue.

For instance, think about a situation the place tax brackets aren’t listed to inflation for 50 years. By then, wages will likely be a lot larger, and practically everybody will likely be within the highest tax bracket, even when they’re low-income earners. By growing tax brackets, the federal government ensures that lower-income earners are usually not unfairly taxed at a excessive price on account of inflation.

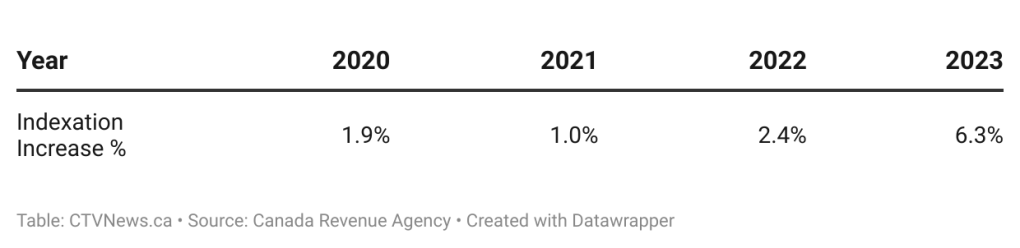

That being stated, Canada’s inflation charges are anticipated to lower transferring into 2024, seemingly leading to a smaller adjustment to the federal revenue tax brackets.

Tax price indexation will increase by 12 months

Here’s a fast take a look at how the federal authorities’s revenue tax brackets have elevated over the previous few years to account for inflation ranges, primarily based on CRA information:

2023 noticed the most important indexation enhance in recent times, which is why the tax brackets have modified considerably.

What is the essential private quantity for 2023?

The primary private quantity is a tax credit score that each one Canadian taxpayers can declare to assist cut back the federal revenue tax they owe. Federal revenue tax charges don’t kick in till after the person has earned greater than the essential private quantity.

In 2022, the essential private quantity was $14,398. This 12 months, nonetheless, the essential private quantity was elevated to $15,000. Moving ahead, the federal authorities introduced that it will start indexing the essential private quantity to inflation (which it beforehand wasn’t).

For higher-income earners, the essential private quantity tax credit score decreases incrementally. If you’re within the 29% tax bracket and earn lower than $235,675 per 12 months, you then’ll be entitled to say the complete $15,000 primary private quantity.

However, when you attain the 33% tax bracket and earn over $235,675 per 12 months, your primary private quantity decreases to $13,521.

Other notable tax and profit modifications for 2023

Here are a number of the different notable modifications that will have an effect on your 2023 taxes.

1. TFSA contribution room enhance

This 12 months, the annual contribution room for tax-free financial savings accounts is $6,500, up from the $6,000 contribution room in 2022. Those who’ve been eligible for the TFSA program since 2009 (when it started) now have a complete contribution room of $88,000.

2. EI premiums enhance

In 2023, Employers Insurance (EI) premiums are growing for each workers and employers. Employees are actually topic to a 1.63% EI premium, and employers are actually topic to a 2.28% EI premium.

3. Introduction of First Home Savings Account (FHSA) in 2023

This 12 months, the federal government is introducing a superb new initiative to assist Canadians save for his or her new properties. The First Home Savings Account (FHSA) permits your contributions to develop tax-free as you put together to buy your first house.

As lengthy as the cash is withdrawn and put in direction of your first house, it’s non-taxable, like a TFSA. Additionally, the contributions you make to an FHSA are tax-deductible, much like an RRSP.

How will the brand new tax brackets have an effect on Canadians?

Tax brackets are listed for inflation to assist maintain the tax price regular, regardless of altering financial situations. It’s good to concentrate on the up to date tax brackets, so you’ll be able to plan for the 12 months and maximize your RRSP contributions and tax deductions.

The up to date tax brackets will assist all of these incomes $50,197 or extra (that was the primary threshold for the 20.5% tax price in 2022), which is now $53,359 in 2023, a big enhance. While tax brackets aren’t that essential throughout wage negotiations, inflation ought to positively be talked about. For instance, if you happen to obtained lower than a 6.3% increase in 2022, your shopping for energy will likely be lower than it was in 2021. That level could possibly be introduced up throughout efficiency critiques along with your boss.

If you’re not sure of methods to account for the modifications your self, it could be useful to talk with a licensed monetary advisor or accountant.

Christopher Liew is a CFA Charterholder and former monetary advisor. He writes private finance ideas for hundreds of day by day Canadian readers on his Wealth Awesome web site.

Do you’ve got a query, tip or story thought about private finance? Please e-mail us at dotcom@bellmedia.ca.