‘Criminal networks’ driving more convincing, frequent tax scams, cybersecurity expert warns

Don’t click on that hyperlink!

The rise of on-line tax scams has one skilled involved as tax season approaches and on-line scammers pump out eerily convincing emails.

“I’m concerned because we haven’t really seen this level of quality from the criminals in the past,” cybersecurity skilled Chester Wisniewski advised CTVNews.ca in a telephone interview on Friday.

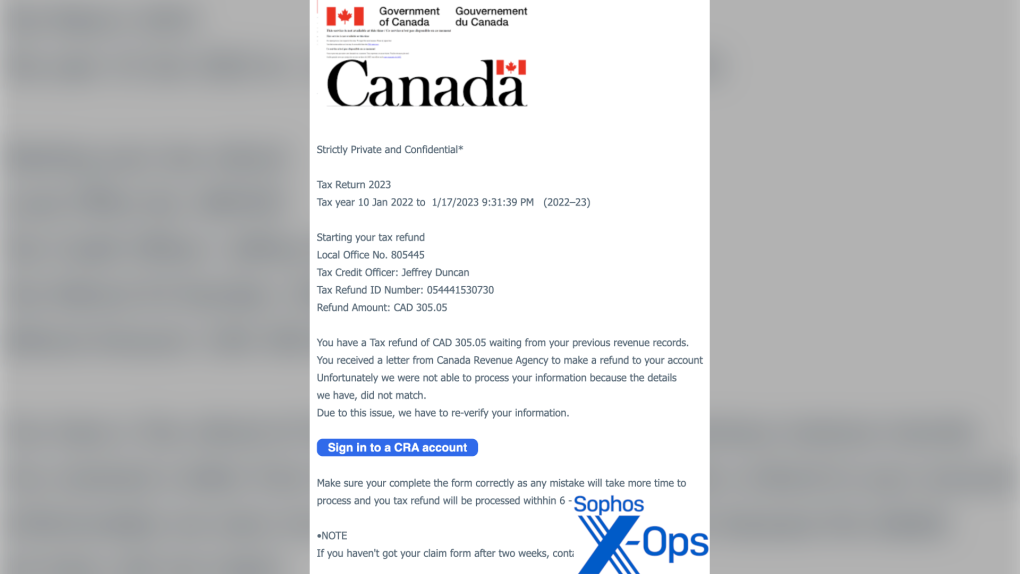

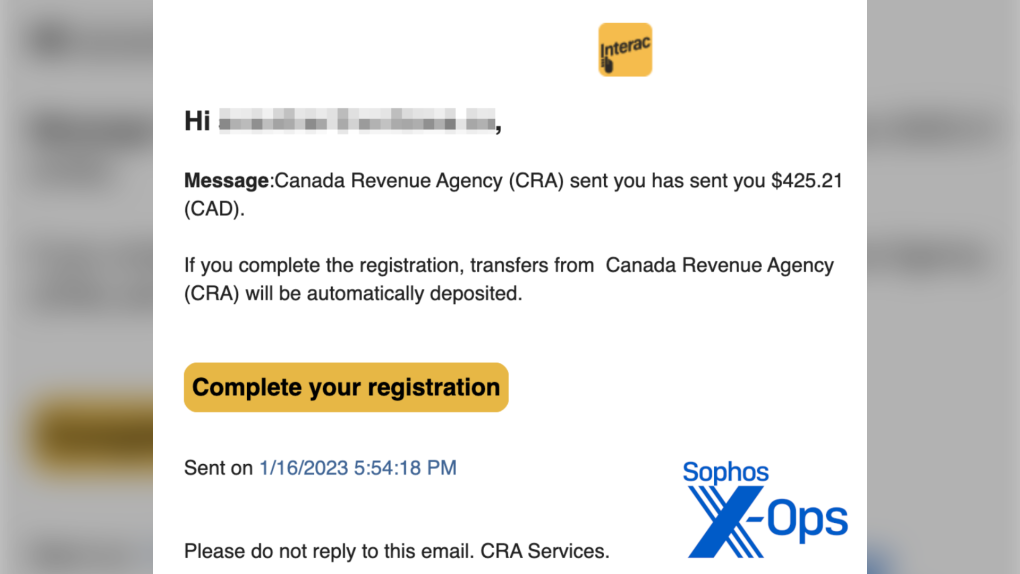

Wisniewski says inside the final decade, scams pretending to originate from the Canada Revenue Agency (CRA) or involving what appears to be like like an official Interac e-Transfer e-mail have develop into extraordinarily subtle, because the community of criminals creating these scams continues to develop.

He says worldwide scammers have made it a degree to even comply with Canadian spelling of their emails to make it extra plausible to Canadians, making it harder to seek out the warning indicators of a phishing rip-off.

“There’s no longer the telltale signs that most people look for that something’s wrong. They don’t look amateur, they don’t have spelling errors or grammatical problems,” he stated.

Cybersecurity skilled Chester Wisniewski says Canadians have to be extra conscious of subtle phishing emails changing into extra more and more convincing and frequent. Photo credit score to Sophos X-Ops.

Cybersecurity skilled Chester Wisniewski says Canadians have to be extra conscious of subtle phishing emails changing into extra more and more convincing and frequent. Photo credit score to Sophos X-Ops.

Those behind phishing and spear phishing scams both fake to be a generic, recognized business or group, or they act as a focused business that a person has present ties to; just like the banking establishment they use every day. According to the Canadian Anti-Fraud Centre (CAFC), 9,000 phishing and spear phishing scams had been reported to the CAFC in 2021, amassing $54 million in sufferer losses.

Wisniewski says these scams have developed from small teams of criminals to total networks the place criminals can purchase and promote their providers to ship and create these pretend emails. He explains a job on this market may appear to be a private being employed to create a financial institution’s brand and write the e-mail in the primary language of the nation being focused. It may additionally contain hiring an individual to hire out a pc, which is then used to ship out phishing scams to essentially the most victims as potential.

“The people that do each job in the criminal ecosystem have got very, very good at it and that’s increasing the success rate of the criminals being able to steal larger amounts of money,” he stated.

STAYING PROTECTED, ESPECIALLY AMID CORPORATE HACKS

The CRA particulars on its web site it’ll by no means demand quick fee or ship a hyperlink along with your refund quantity on-line, and it’ll solely contact people to inform them of a brand new message, adopted by instructions to go to their CRA portal.

Wisniewski says as a result of the CRA will solely strategy people on-line for message notifications, it may be simpler to detect fraudulent exercise from scammers pretending to be the CRA. However, he says, he is involved with emails from scammers pretending to be banking establishments or focused companies, particularly after latest cybersecurity assaults.

Indigo was not too long ago affected by a cyberattack that impacted the bookstore chain’s web site and digital fee system. While it is nonetheless unknown if buyer knowledge was impacted, Wisniewski explains related cyberattacks that achieve entry to clients’ private knowledge may make e-mail scams extra plausible.

Cybersecurity skilled Chester Wisniewski says Canadians have to be extra conscious of subtle phishing emails changing into extra more and more convincing and frequent. Photo credit score to Sophos X-Ops.

Cybersecurity skilled Chester Wisniewski says Canadians have to be extra conscious of subtle phishing emails changing into extra more and more convincing and frequent. Photo credit score to Sophos X-Ops.

“We do see them impersonate name brands after these big hacks, where they now know all these people have a Marriott Rewards number or they know that people have an Indigo account,” he stated.

“As a result, this lends more credibility to something you’re used to interacting with.”

Ultimately, Canadians have to be on alert for suspicious and unsolicited emails, texts and telephone calls as scammers get a head begin on tax season, Wisniewski stated.

He recommends not clicking any hyperlinks for funds you are not anticipating, or in the event you’re being despatched an e-mail from the CRA, go on to your CRA account, slightly than clicking any hyperlinks, to see if the message is the truth is genuine.

“I would expect that we will not only continue to see them, we’ll likely see more of them, in more frequency, as we get closer to tax day,” he stated.