Only 6% of Canadians use cash at grocery stores: study

A research from Dalhousie University revealed Thursday reveals solely 6 per cent of Canadians nonetheless pay with money solely.

In partnership with Angus Reid, the Halifax-based University’s nationwide research “Cashed Out: How a Cashless Economy Impacts Your Grocery Experience, a Canadian Perspective” noticed over 1,500 Canadians surveyed in January.

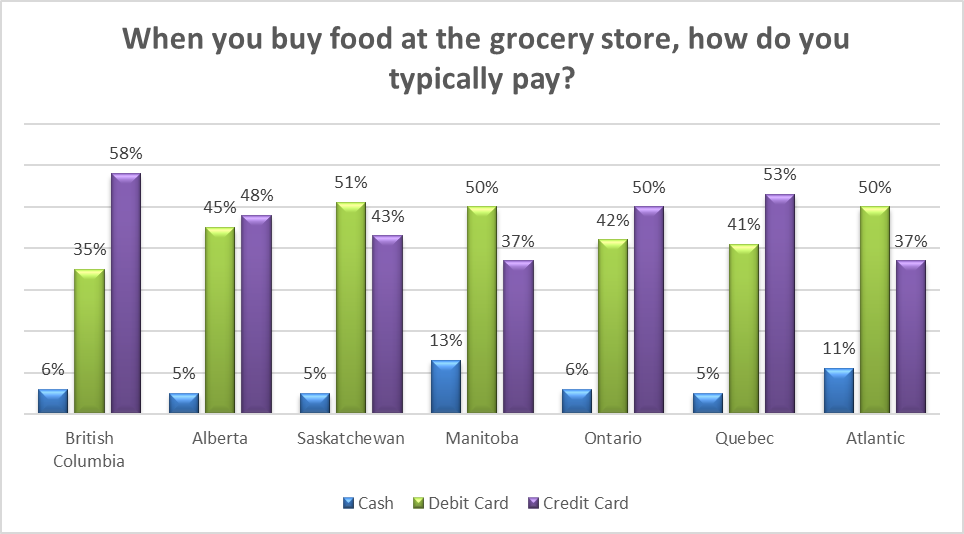

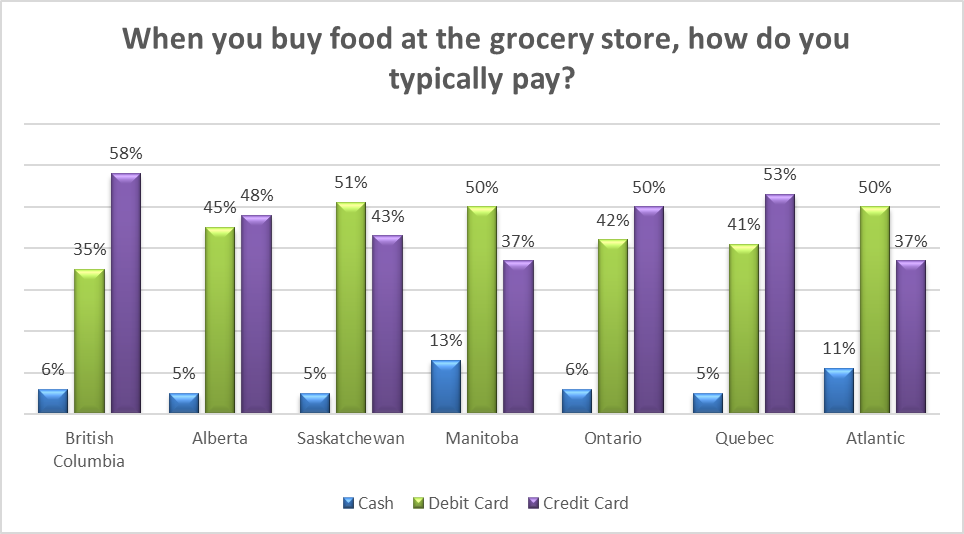

Of the teams that pay with money at grocery shops, Manitoba has the very best proportion at 13 per cent, while Alberta is among the many least with 5 per cent alongside Quebec and Saskatchewan.

Credit playing cards are the preferred fee methodology in British Columbia, at 58 per cent, whereas Manitoba and the Atlantic provinces are the bottom, at 37 per cent.

However, in the case of Canadians utilizing money, the report notes a paradox.

Only 27 per cent of Canadians imagine utilizing money is outdated, whereas 74 per cent of Canadians imagine utilizing money is inconvenient. Only 26 per cent of Canadians imagine grocery shops gained’t settle for money inside 5 years.

The report additionally exhibits that there’s a concern for a cashless grocery system, as it might result in a future that would depart out the marginalized with out banking entry.

Sixty per cent of Canadians imagine money is vital since it’s the solely technique to assist some charities amassing donations at grocery shops.

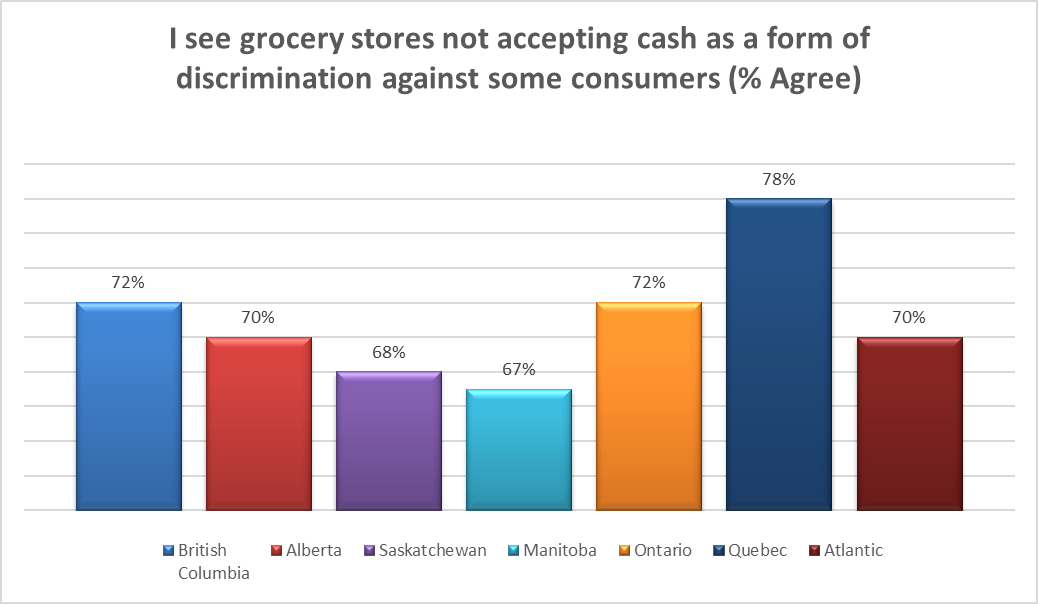

In addition, Canadians really feel strongly a few cashless grocery retailer when speaking about discrimination. A complete of 73 per cent imagine a cashless grocery retailer might be discriminatory, with Quebec having the very best proportion.

However, economists, like Concordia University Professor Moshe Lander, argue that card funds will not be solely handy but in addition cost-effective.

“Any store these days will pretty much accept debit and credit technology, and the cost has come down enough that from their standpoint, it’s more efficient. They don’t have to deal with Brink’s trucks coming in, dropping off cash, picking it up, moving it to bank accounts … it’s a much smoother system,” Lander stated.

“I think that other than maybe a few underbanked, unbanked, and maybe senior citizens that are still a little bit skeptical about debit and credit technology, we’re not far away from being done with cash for good.”

According to the Financial Consumer Agency of Canada (FCAC), in 2022 an estimated 6 per cent of Canadian households, or 1.5 million houses, have been unbanked, that means they’d no account at a monetary establishment.

The FCAC additionally estimated round 15 per cent of Canadian households have been thought-about underbanked, that means they’d an account at a monetary establishment however nonetheless used different monetary providers corresponding to payday loans or cheque-cashing providers.

Factors that contribute to being unbanked or underbanked embody low earnings, lack of training, and immigration standing.

Related Stories:

-

Is the way forward for Canada a cashless society?

-

Loblaw says it has unfairly change into ‘the face of meals inflation’

-

Bank of Canada hikes key rate of interest to 4.5%, says it plans to carry

CityNews spoke with some Calgarians on how they really feel about cashless grocery shops.

“There are so many people who deal with cash and especially seniors because they are not tech savvy like us,” stated Nikhil Sachdeva.

“There are certain minorities that benefit from using cash, such as the homeless and elderly. I think they should be supported with using cash in grocery stores,” stated fellow Calgarian Amanda Wine.

The survey additionally stories that greater than half of Canadians contemplate a cashless financial system to be a risk to their very own privateness.

But Lander disagrees.

He says digital transactions and data assortment will not be new phenomena to be afraid of.

“Grocery stores are monitoring you every time you use your grocery store club card, like Safeway card or Save On Foods card. You don’t have to use a credit card. Even if you pay in cash, they’re still monitoring your purchases,” stated Lander.

“They are still catering the promotions and the specials that they offer you, based on what you purchase, not which card you use or whether you use cash, he added.”

The publish Only 6% of Canadians use money at grocery shops: research appeared first on CityNews Calgary.